More Info: Fix the Federal HST New Home Rebate Program

Why buyers of new homes need a rebate program that actually delivers

By Dave Wilkes, President & CEO of BILD for the Toronto Star

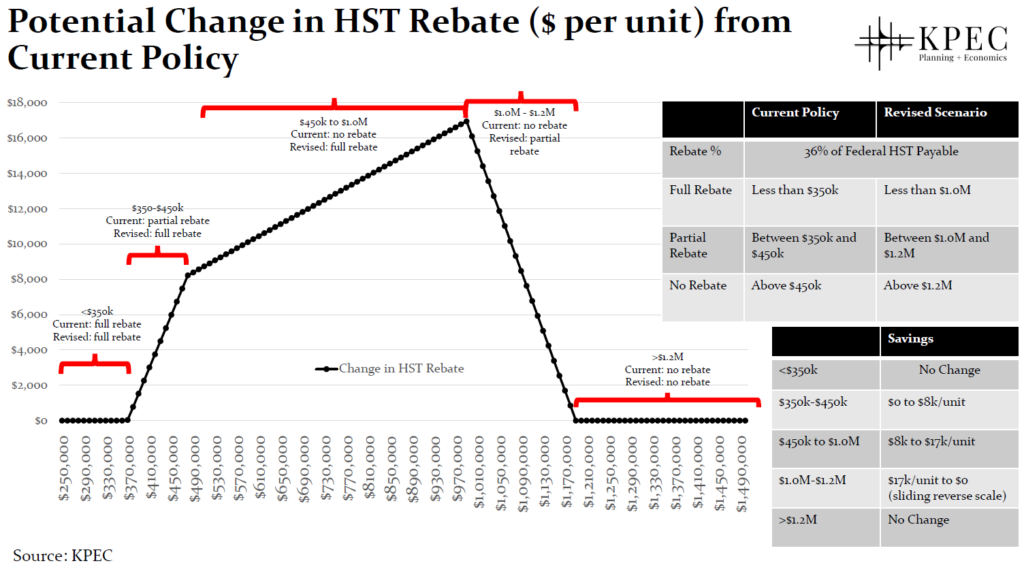

Since the imposition of HST on new homes began, the threshold price-points for the rebates have not changed from $350,000 (maximum $6,300 rebate) or $450,000 (above which no rebates apply). This despite the government pledging to review and adjust the price rebate thresholds at least every two years to reflect changes in economic conditions and the housing markets. Below is the exact commitment made by the government.

“The government will review these thresholds at least every two years and adjust them as necessary to ensure that they adequately reflect changes in economic conditions and housing markets”

– Goods and Services Tax Technical Paper, August 1989 (Page 19)

Given that housing prices for a single family home on average in Ontario (based on CMHC data) have increased from $276,000 in 1990 to $1,023,000 in 2023, an increase of 270%, the practical implications are:

- That virtually no new home buyer in the GTA is eligible to receive a rebate under the rebate program.

- The Federal government has collected in Ontario for single-detached units alone nearly $4.0 billion in additional HST revenues*

The figure below demonstrates that if the HST rebate program were to be indexed by the amount that property values have increased in Ontario since the introduction of the tax – that a qualified new home purchaser of a condominium of $999,000 would receive a federal rebate of approximately $17,000.00 vs $0 today. And a total combined HST (Federal + Provincial) rebate of $41,000, up from the $24,000 provided by the province today.

Click here to return to the #DoSomething landing page